These are typically identified on the credit report through Remarks Codes such as “Forfeit deed-in-lieu of foreclosure.”Ī preforeclosure sale or short sale is the sale of a property in lieu of a foreclosure resulting in a payoff of less than the total amount owed, which was pre-approved by the servicer. These transaction types are completed as alternatives to foreclosure.Ī deed-in-lieu of foreclosure is a transaction in which the deed to the real property is transferred back to the servicer. Debts that were not satisfied by a bankruptcy must be paid off or have an acceptable, established repayment schedule.ĭeed-in-Lieu of Foreclosure, Preforeclosure Sale, and Charge-Off of a Mortgage Account The documentation must establish the completion date of a previous foreclosure, deed-in-lieu or preforeclosure sale, or date of the charge-off of a mortgage account confirm the bankruptcy discharge or dismissal date and identify debts that were not satisfied by the bankruptcy.

If not clearly identified in the credit report, the lender must obtain copies of appropriate documentation. Significant derogatory credit events may not be accurately reported or consistently reported in the same manner by all creditors or credit reporting agencies.

#Fannie mae foreclosures rules full

Remarks Codes are descriptive text or codes that appear on a tradeline, such as “Foreclosure,” “Forfeit deed-in-lieu of foreclosure,” and “Settled for less than full balance.”

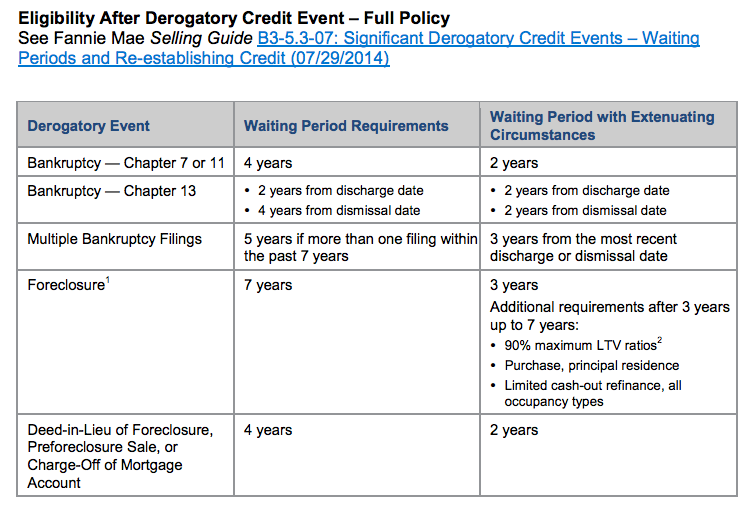

Lenders must carefully review the current status of each tradeline, manner of payment codes, and remarks to identify these types of significant derogatory credit events. Lenders must review the public records section of the credit report and all tradelines, including mortgage accounts (first liens, second liens, home improvement loans, HELOCs, and manufactured home loans), to identify previous foreclosures, deeds-in-lieu, preforeclosure sales, charge-offs of mortgage accounts, and bankruptcies. Lenders must review the credit report and the Declarations in the loan application to identify instances of significant derogatory credit events. Identification of Significant Derogatory Credit Events in the Credit Report Also see B3-5.3-08, Extenuating Circumstances for Derogatory Credit, for additional information. See B3-5.3-09, DU Credit Report Analysis, for additional information pertaining to DU loan casefiles, including how the waiting period is determined. The waiting period commences on the completion, discharge, or dismissal date (as applicable) of the derogatory credit event and ends on the disbursement date of the new loan for manually underwritten loans. This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is eligible for a new loan salable to Fannie Mae.

The lender must make the final decision about the acceptability of a borrower’s credit history when significant derogatory credit information exists. The lender must determine the cause and significance of the derogatory information, verify that sufficient time has elapsed since the date of the last derogatory information, and confirm that the borrower has re-established an acceptable credit history. Note: The terms “preforeclosure sale” and “short sale” are used interchangeably in this Guide and have the same meaning (see Deed-in-Lieu of Foreclosure, Preforeclosure Sale, and Charge-Off of a Mortgage Account below).

0 kommentar(er)

0 kommentar(er)